Loan Program Examples

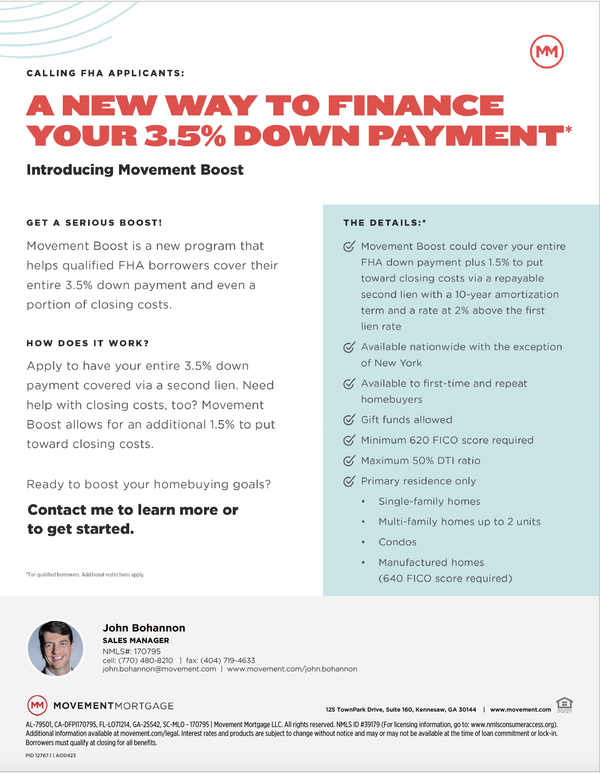

I recently spoke with a lender that has assisted several of my clients. He provided a few examples on programs that can help!

These examples are for a bridge loan product called Trade Up…if you already have a home that you need to sell after you buy the new one. This could allow you to buy before you sell and use equity from your current home to make a new down payment.

While I can refer you to lenders, I always recommend researching different lenders and loan types to get the best loan for your situation. I provide this information as examples of what is out there so that you can pursue your goals of owning your dream home.

*All programs are dependent on the lender and their qualifications.

Sellers are becoming increasingly more willing to provide buyer concessions at closing. What is a concession? Sometimes called seller assists or seller contributions, seller concessions are closing costs that the Seller agrees to pay to reduce the cash the Buyer needs to bring to the closing table. For example, a Seller may give a concession to buy down the interest rate the Buyer will have over a year or two. The amount the interest rate will lower and the term it will be lowered is dependent on the amount of the Seller concession negotiated and the amount of the Buyer’s down payment.

It is important to consider how you negotiate your purchase. You can lower your monthly payment significantly by applying a Seller concession toward lowering the interest rate vs requesting to reduce the sales price by the same amount. The reason many are doing this is if you lower the interest rate for a year or two it could potentially give time for the market to shift and the rates to go down again. Then the loan can be refinanced to the lower rate. There are risks associated with this approach. If the market does not shift or you cannot refinance due to credit or income changes you run the risk of your payment going up to the original interest rate at the end of the buy down period. This is why it is important to speak to different lenders and compare lending products and evaluate who you feel will provide the best lending advice.

I hope these examples help you see what options you may have for purchasing a home. I would be honored to have the opportunity to talk with you about your home buying or selling needs.

Take a look at this fantastic listing in Cumming GA!

Click here to view 2855 Woodland Hills Dr., Cumming GA 30040

Meet Marylou

Hi! I am MaryLou Luhring, a Realtor in the Atlanta, GA metro area. I am known for my caring personality and strategic negotiation skills. Learn more clicking here.

Hi! I am MaryLou Luhring, a Realtor in the Atlanta, GA metro area. I am known for my caring personality and strategic negotiation skills. Learn more clicking here.